Styles of Crypto Options:

It's important to note that European-style options, while only exercisable at expiry, can still be traded or closed out early by the buyer.

Types of Options:

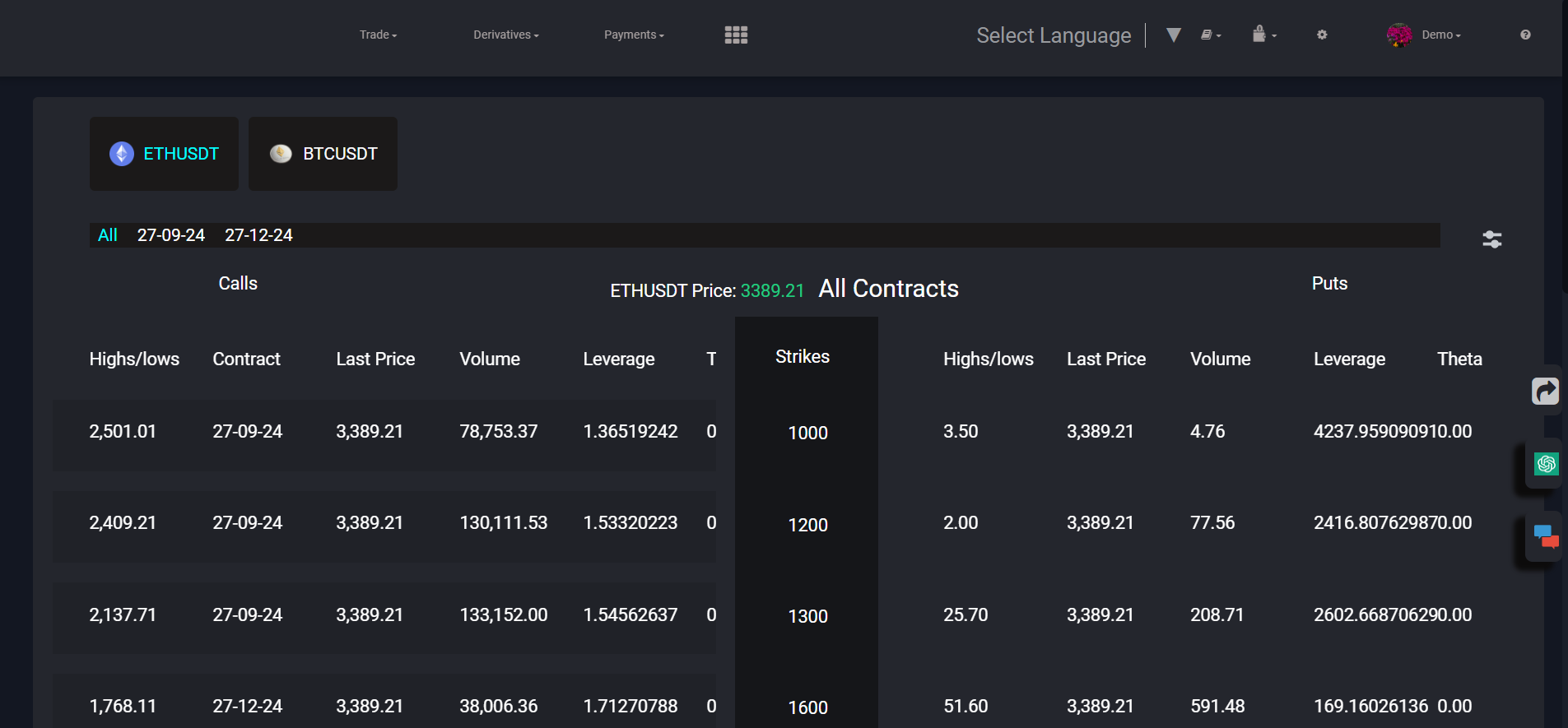

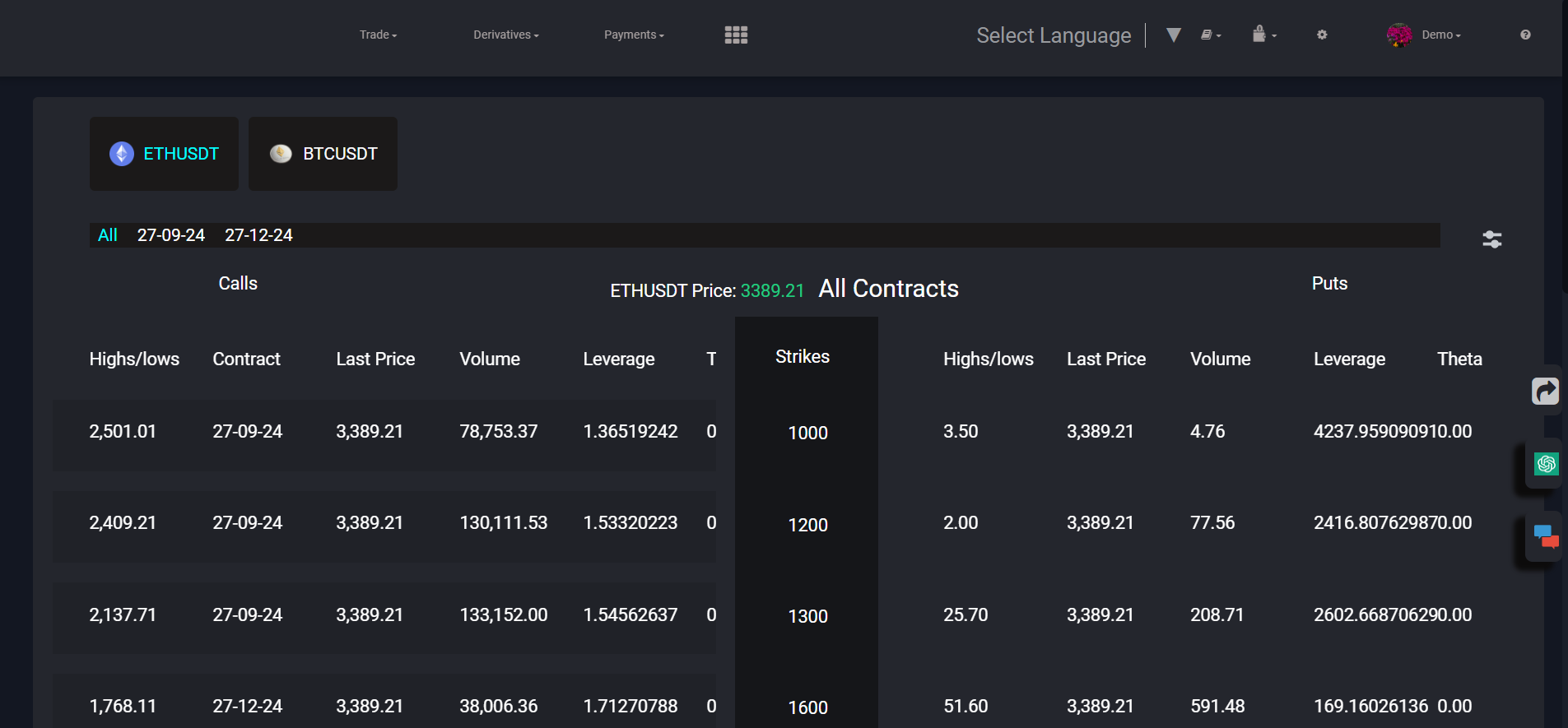

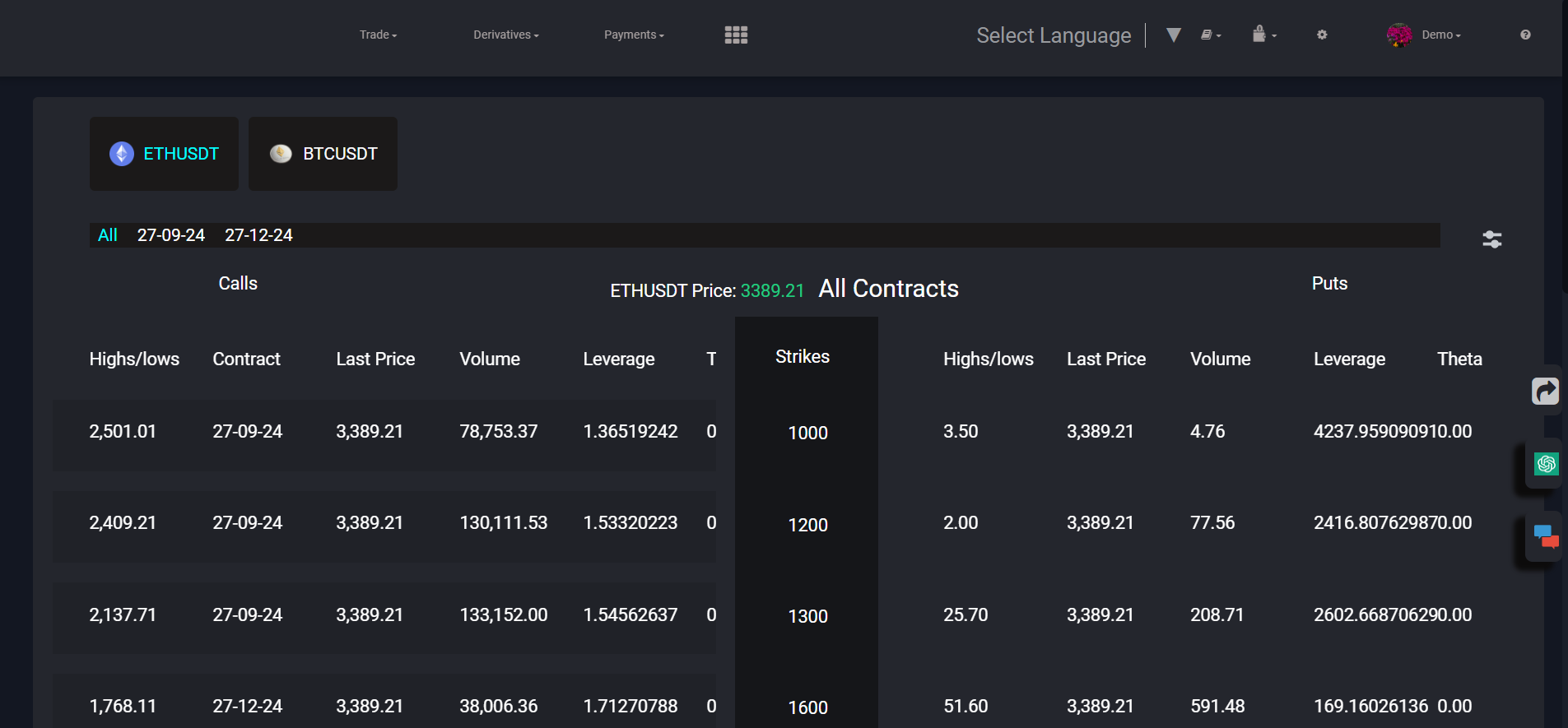

An options seller "writes" (creates) call and put options contracts, each with an expiration date and a "strike price," which is the price at which the contract buyer can buy or sell the underlying asset upon expiry (or before if it’s an American-style option). The seller then lists the contracts on a crypto options exchange. Alternatively, a buyer can place an order on the exchange, and a seller can sell it.

The cost of an option is known as a "premium." Similar to insurance, this premium provides protection; for example, a put option serves as downside protection. If the price of the underlying asset falls below the strike price, the options writer is obligated to buy the asset from the owner at the fixed price.

The premium's price depends on several factors:

The current price of the underlying asset significantly affects the premium cost:

A trader buying a call option with a strike price lower than the current market value of the underlying asset will pay a higher premium because the contract is "in the money" and has intrinsic value. However, this does not guarantee that the price will remain above the strike price until the contract expires.

Each contract gives Bob the right to purchase 0.1 bitcoin at $36,000 per coin, allowing him to buy one bitcoin at $36,000 when the contract expires.

Option Greeks refer to four factors that influence the price of an option premium, derived from the Black-Scholes Model, a method created in 1973 by Fischer Black, Myron Scholes, and Robert Merton to standardize option pricing. The model is widely used for European-style options, while American options use other methods like the Binomial model.

The Greeks are:

Going "naked" with options means taking an options position without holding the opposite position in the underlying asset.

Selling naked options is risky and can lead to significant losses. Typically, sellers own the underlying asset to cover potential losses. For example, if an options seller owns the asset, they can mitigate losses if the price moves against them.

Example Scenarios:

1. Covered Position:

Despite the risks, some sellers choose naked options to avoid investing their own capital upfront, as they stand to gain in two out of three scenarios:

Sellers must calculate the risks based on the underlying asset's volatility to decide if earning premiums without upfront investment is worth it.