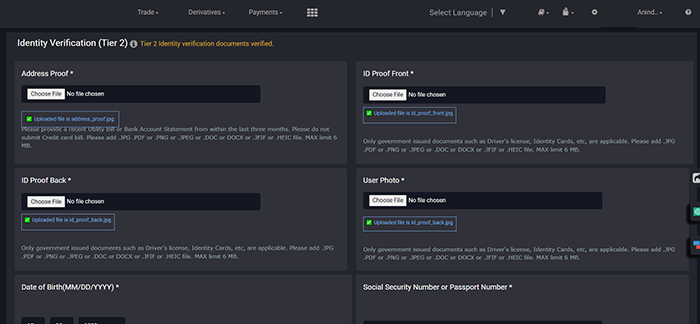

For document verification in the account we may require the following documents to be uploaded to your account:

Profile Photo:

Note :

- Please click a photo without wearing any hats, masks or glasses.

- Kindly hold your ID Proof and Address Proof Document and a sheet of Paper with the Text - 'Only for trading cryptocurrencies. Ensure all documents are clearly visible in the photo.

Address Proof:

Note :Utility Bill or Bank Account Statement from the last 3 months. Please do not submit a Credit card bill.

ID Proof Front:

ID Proof Back:

Note :Only government-issued documents such as Driver's licenses, Identity Cards, etc., are applicable

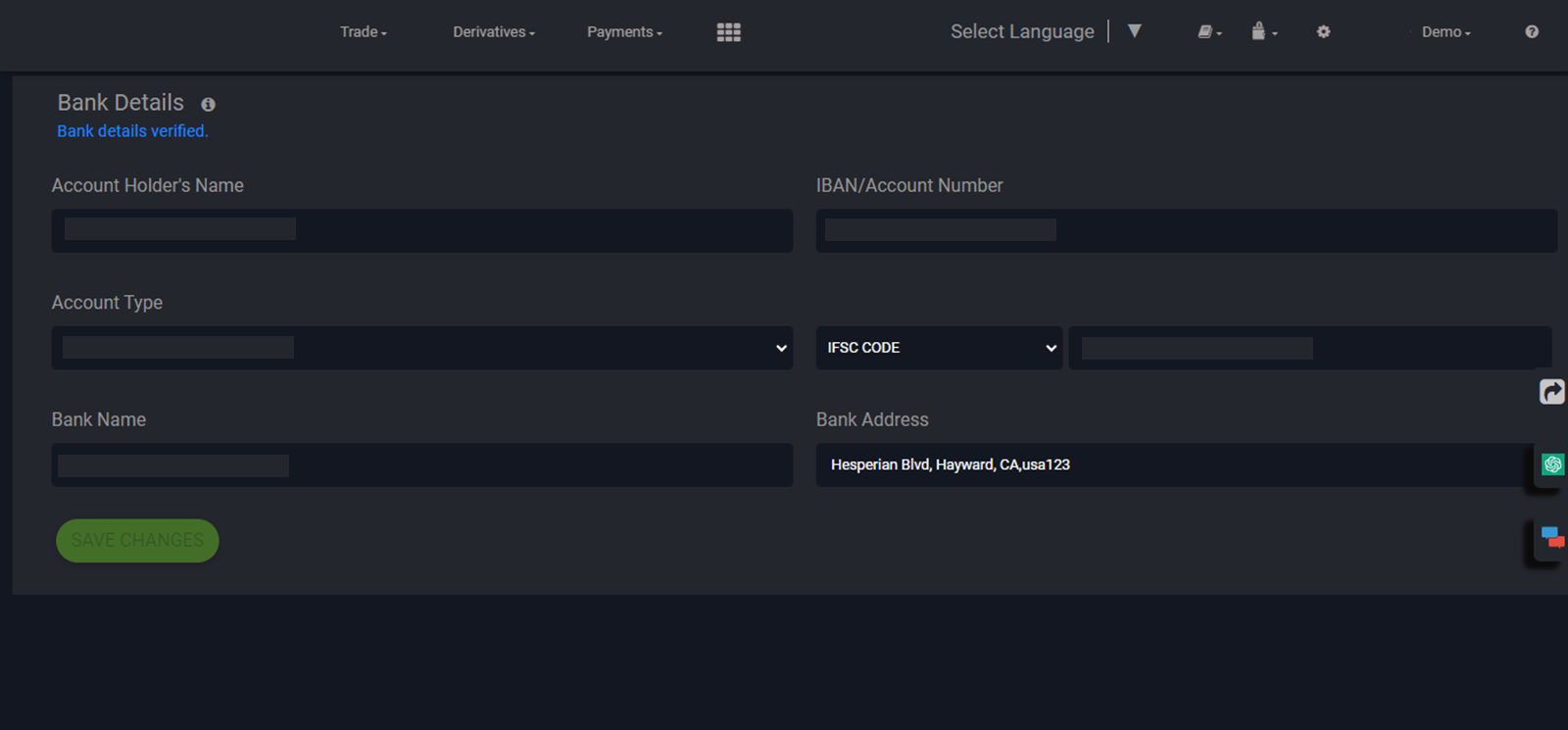

Bank Details:

For Tier 3 account:

We may need the following details.

- Tax ID number

- Tax Statement

- Bank Statement

Bank Details:

A compromised device can log everything you type into it, and mobile devices are the most common way to use 2-Factor Authentication (2FA).

- Account Holder's Name

- Bank Name

- Account Number

- Routing No/IFSC Code/IBAN No

Note :Account Holder's name should match the name provided while signing up.

Why is Verifying Documents Crucial?

In our fast-changing digital world, where transactions happen instantly and fake identities are common, document verification is more crucial than ever. It ensures trust, prevents financial losses, and stops scams.

Digital transactions are convenient but also attract fraud. Document verification stops this by confirming real documents and people, guarding against online deception.

Governments and rules are stricter against financial crimes. Document checks help companies follow these rules, like verifying customers (KYC), preventing illegal money activities (AML), and avoiding legal troubles.

Cybercriminals are more intelligent, but document verification fights back. Therefore, using modern methods like fingerprints and databases. Moreover, it stops cyber threats and keeps data safe.

Privacy worries are big. However, document verification keeps data private, building trust. Moreover, it helps companies avoid risks, be respected, and stay reliable.

Easy, quick processes matter. Document verification makes joining a business smooth, and pleasing customers. Moreover, it's the key in today's digital world for safety, trust, and success.